How to Deal with Common Car Accidents and Insurance Claims: A Practical Guide

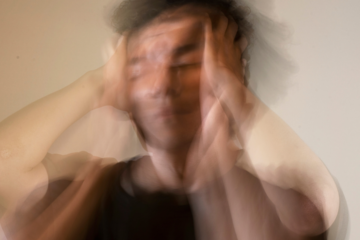

Car accidents can be stressful and overwhelming, often leaving individuals unsure of the next steps to take. Understanding how to deal with these situations, including filing insurance claims, can significantly ease the burden. Knowing what to do immediately after an accident can help prevent complications later on.

Accidents vary in severity and impact, but certain steps remain consistent across all scenarios. Gathering relevant information, such as documentation from the scene and insurance details, is crucial for a smooth claims process. Being informed about one’s coverage options and potential expenses can also play a vital role in navigating the aftermath.

Insurance claims can often be a complicated process, influenced by numerous factors. Having a clear plan in mind can make a difference in how effectively one manages the situation. Being prepared with the right knowledge ensures individuals are ready to tackle the challenges that arise after a car accident. Alternatively, they can also contact professionals who provide accident management services. Such experts tend to offer comprehensive solutions, including vehicle recovery, car repair, and insurance claims management.

Understanding Car Accidents

Car accidents can occur for various reasons and can take several forms. Recognizing the common causes and types of accidents is essential for handling the aftermath effectively.

Common Causes of Car Accidents

Many factors contribute to car accidents. Some of the most prevalent causes include:

- Distracted Driving: Activities like texting, eating, or adjusting the radio divert attention from the road.

- Speeding: Exceeding the speed limit reduces reaction time and increases the severity of collisions.

- Driving Under the Influence: Alcohol and drugs impair judgment and coordination, significantly heightening accident risks.

- Weather Conditions: Rain, snow, and fog can obscure visibility and cause slippery roads.

- Mechanical Failures: Issues like brake failure or tire blowouts can lead to loss of vehicle control.

Understanding these factors can help drivers take precautions.

Types of Car Accidents

Car accidents vary widely in nature. Some common types include:

- Rear-End Collisions: Typically occur when one vehicle hits the back of another, often due to sudden stops.

- Side-Impact Accidents: Also known as T-Bone accidents, these involve one car striking the side of another, usually at intersections.

- Head-On Collisions: These serious accidents happen when two vehicles collide front-to-front, often resulting in severe injuries.

- Single-Vehicle Accidents: These involve only one car, typically due to losing control or hitting a stationary object.

- Multi-Vehicle Pile-Ups: Complex situations where several cars collide, often seen on highways during traffic jams.

Recognizing these types enhances awareness on the road.

Navigating Insurance Claims

Handling insurance claims after a car accident is a crucial step in the recovery process. It involves specific actions that ensure proper compensation for damages and injuries. This section covers the initial steps, filing the claim, interacting with adjusters, and understanding coverage details.

Initial Steps After an Accident

Following an accident, the first priority is safety. Ensuring that all parties are safe and moving to a secure location is vital.

Next, gather essential information. This includes:

- Names and contact details of individuals involved.

- License plate numbers and vehicle descriptions.

- Insurance information for all parties.

- Contact information for any witnesses.

Document the scene with photos. Capture any damage to vehicles, road conditions, and relevant signage. This visual evidence supports claims and clarifies circumstances later.

Seek medical attention even if injuries seem minor. Some symptoms may develop later, and having medical records will aid future claims.

Filing an Insurance Claim

Filing a claim requires notifying the insurance company promptly. Most policies specify a time frame for reporting accidents, typically within 24 hours.

When reporting, provide detailed information. This includes:

- Accident details (date, time, location).

- Description of events leading up to the accident.

- All collected information from the scene.

Fill out claim forms accurately. Missing or incorrect information can delay the process. Attach any relevant documentation, such as police reports or medical bills.

After submission, keep track of the claim’s progress by maintaining open communication with the insurer. Document all interactions, including dates, names, and what was discussed.

Dealing With Insurance Adjusters

Insurance adjusters investigate claims. They assess damages, verifying the details that led to the incident. It’s essential to remain polite yet assertive during communications.

Be prepared to answer questions about the accident. Provide clear, concise information without admitting fault. Fault determination may affect the compensation amount.

Request a copy of the adjuster’s report. This report outlines their assessment and reasoning behind their decision. Reviewing it helps ensure that all details are correct.

Negotiation may follow the initial offer. Understand the value of damages sustained. If the offer seems low, justify the counter-offer with documentation of repair estimates and medical costs. If you feel the adjuster is not acting in good faith or is denying the claim, consider reaching out to a Bad Faith Insurance Attorney for assistance. They can handle your case to ensure that you are getting the legal support necessary to challenge these unfair practices.

Understanding Your Coverage

Knowledge of specific policy details is crucial. Different types of coverage may influence the claims process. The most common include:

- Liability Coverage: Covers damages to another party if the insured is at fault.

- Collision Coverage: Addresses damage to the insured’s vehicle, regardless of fault.

- Comprehensive Coverage: Covers non-collision-related incidents, such as theft or natural disasters.

Review policy limits and deductibles. These factors impact out-of-pocket expenses and compensation amounts. Familiarity with coverage helps manage expectations and prepares the policyholder for negotiations with insurers.

Legal Considerations

Navigating the legal landscape after a car accident is crucial for ensuring proper claims and protection of rights. Awareness of when legal assistance is needed and understanding legal terminology and procedures will empower individuals in these situations.

When to Hire an Attorney

Hiring an attorney from somewhere professional like The Law Office of Carl Maltese can be essential in various scenarios following a car accident. If injuries are serious or if liability is disputed, legal representation may be necessary. An attorney can provide insight into the complexities of a case, especially when dealing with large insurance companies.

Claimants should consider legal counsel if:

- They feel overwhelmed by the process.

- The insurance company is uncooperative.

- There are multiple parties involved.

- They face potential lawsuits.

An experienced attorney can help negotiate settlements and navigate court proceedings if required.

Legal Terms and Procedures

Understanding key legal terms and procedures is vital for anyone involved in a car accident. Important concepts include:

- Liability: Refers to the responsibility for damages.

- Negligence: A failure to act with reasonable care, leading to accidents.

- Claim: A request for compensation from an insurance company.

The process typically involves:

- Filing a Claim: Submit necessary documents to the insurer.

- Investigation: The insurance company assesses the incident.

- Negotiation: Both parties may negotiate a settlement.

- Litigation: If a settlement cannot be reached, the case may go to court.

Knowledge of these terms and steps can aid in effectively managing claims and legal rights.

Ensuring Vehicle Safety Before Getting Back on the Road

After addressing the legal and insurance aspects and once the initial stress has subsided, attention should turn to the vehicle’s internal safety systems. While exterior damage is often visible, hidden issues may silently compromise the vehicle’s performance and safety.

For example, if the airbags deployed during the accident, replacing them isn’t enough. A professional airbag module reset is often required to ensure the system functions correctly in future collisions. Skipping this step could leave occupants vulnerable and may even lead to legal consequences.

Similarly, seat belts that locked up or absorbed impact may look fine, but could have sustained internal damage. So, expert inspection and repair are essential to restore their effectiveness.

Ultimately, addressing these hidden safety concerns could not only restore a vehicle’s mechanical integrity but also ensure compliance with legal safety standards, making it truly road-ready.

0 Comments